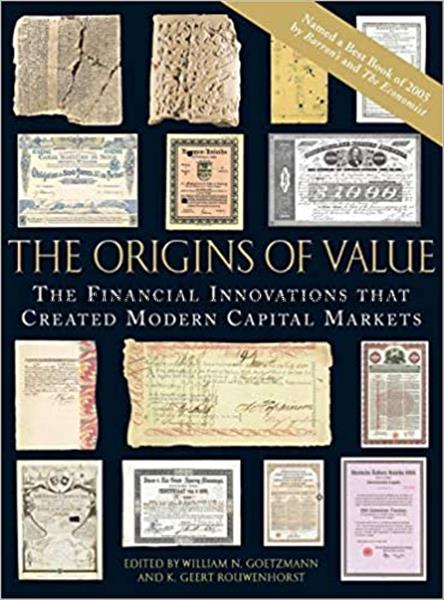

The origins of value : the financial innovations that created modern capital markets / edited by William N. Goetzmann and K. Geert Rouwenhorst

Author : Lowenstein, Roger

From the invention of interest in Mesopotamia and the origin of paper money in China, to the creation of mutual funds, inflation-indexed bonds, and global financial securities, here is a sweeping survey of financial innovations that have changed the world. Written by a distinguished group of experts--including Robert Shiller, Niall Ferguson, Valerie Hansen, and many others--and wonderfully illustrated with over one hundred color photographs of landmark financial documents (including the first paper money), The Origins of Value traces the evolution of finance through 4,000 years of history. Readers see how and why many of our most important financial tools and institutions--loans, interest rates, stocks, bonds, mutual funds, the corporation, and the New York Stock Exchange, to name a few--came into being. We see, for instance, how ancient Rome developed an early form of equity finance that resembles the modern corporation and read about the first modern corporation--the Dutch East India Company--and its innovative means of financing the exploration and expansion of European business ventures around the globe. We also meet remarkable financial innovators, such as the 13th century Italian Fibonacci of Pisa, whose mathematics of money became the foundation for later developments in the technology of Western European finance (and may explain why the West surpassed the East in financial sophistication). And we even discover a still-surviving "perpetuity" dating from the Dutch Age of Reason--an instrument that has been paying interest since the mid-17th century. Placing our current age of financial revolution in fascinating historical perspective, The Origins of Value tells a remarkable story of invention, illuminating many key episodes in the course of financial history

| Barcode | Call No. | Volume | Status | Due Date | Total Queue | |

|---|---|---|---|---|---|---|

| 1010071945 | FM00040 | Available | 0 | Please Login |

Related Book