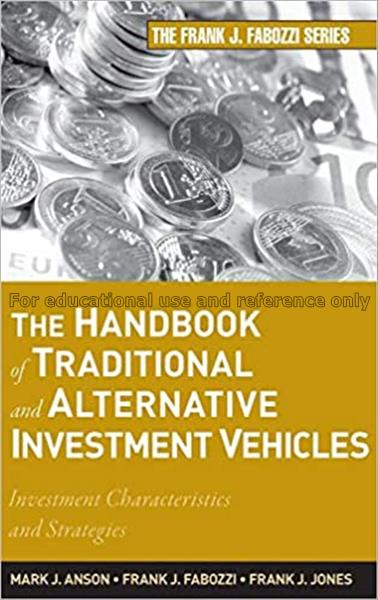

A comprehensive volume that covers a complete array of traditional and alternative investment vehicles This practical guide provides a comprehensive overview of traditional and alternative investment vehicles for professional and individual investors hoping to gain a deeper understanding of the benefits and pitfalls of using these products. In it, expert authors Mark Anson, Frank Fabozzi, and Frank Jones clearly present the major principles and methods of investing and their risks and rewards. Along the way, they focus on providing you with the information needed to successfully invest using a host of different methods depending upon your needs and goals. •Topics include equities, all types of fixed income securities, investment-oriented insurance products, mutual funds, closed-end funds, investment companies, exchange-traded funds, futures, options, hedge funds, private equity, and real estate •Written by the expert author team of Mark Anson, Frank Fabozzi, and Frank Jones •Includes valuable insights for everyone from finance professionals to individual investors Many finance books offer collections of expertise on one or two areas of finance, but The Handbook of Traditional and Alternative Investment Vehicles brings all of these topics together in one comprehensive volume. Key Topics Covered: CHAPTER 1: Introduction. CHAPTER 2: Investing in Common Stock. CHAPTER 3: More on Common Stock. CHAPTER 4: Bond Basics. CHAPTER 5: U.S. Treasury and Federal Agency Securities. CHAPTER 6: Municipal Securities. CHAPTER 7: Corporate Fixed Income Securities. CHAPTER 8: Agency Mortgage Pass through Securities. CHAPTER 9: Agency Collateralized Mortgage Obligations. CHAPTER 10: Structured Credit Products. CHAPTER 11: Investment-Oriented Life Insurance. CHAPTER 12: Investment Companies. CHAPTER 13: Exchange-Traded Funds. CHAPTER 14: Investing in Real Estate. CHAPTER 15: Investing in Real Estate Investment Trusts. CHAPTER 16: Introduction to Hedge Funds. CHAPTER 17: Considerations in Investing in Hedge Funds. CHAPTER 18: Investing in Capital Venture Funds. CHAPTER 19: Investing in Leveraged Buyouts. CHAPTER 20: Investing in Mezzanine Debt. CHAPTER 21: Investing in Distressed Debt. CHAPTER 22: Investing in Commodities

| Barcode | Call No. | Volume | Status | Due Date | Total Queue | |

|---|---|---|---|---|---|---|

| Not Found | ||||||